Saving Surge: Analyzing the Growth of Postal Saving Schemes in India and Punjab State of India

Main Article Content

Abstract

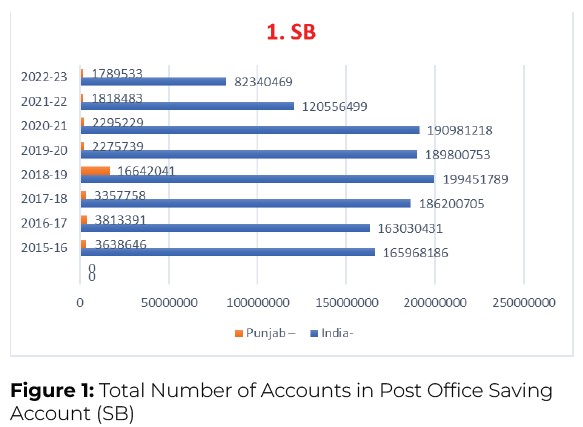

Savings in post offices are regarded safest because of traditional faith and regular returns. People specially from rural areas are more associated with these schemes because of easy accessibility. Post office saving schemes are generating significant amount of funds from small investors with its different schemes as postal department has launched core banking solutions to improve the operational efficiency of saving plans. Over the years, post office schemes attracted large number of investors to make investment in different saving plans. The present paper intends to evaluate the growth of various saving schemes offered by Post Office Saving Bank in India and Punjab along with percentage contribution of Punjab in it. An analysis of accessible data on number of accounts is presented using compounded annual growth rate and percentage analysis. Secondary data of last eight years i.e., from year 2015-16 to 2022-23 is extracted from annual reports of postal department. Growth measurement of data reveals maximum growth in number of accounts of Sukanya Samriddhi Account in India and Punjab. The study revealed that other saving schemes experienced either lower or negative growth, while Punjab Circle accounted for only four percent of the total number of accounts under different saving schemes. The study suggests that post offices should work on strategic marketing promotional tools to improve the growth of saving plans.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

CC BY-NC-SA 4.0

Attribution Non-Commercial Share-alike 4.0 International

Visit here for more details: https://creativecommons.org/licenses/by-nc-sa/4.0/

References

Ashish, S., & Singh, H. B. (2018). Analysis of Trends in Gross Domestic and Household Savings and Its Components in India, Studies in Business and Economics, 13(1), 181-193.

Bhuvaneswari, D., & Tamilarasi, S. (2020). Evaluating The Patrons Perception on Performance of Postal Services During Covid19 Outbreak in Chennai City. PalArch'sJournal of Archaeology of Egypt/Egyptology, 17(6), 2927-2933.

Chougale, J. A. (2021). Service Quality of Postal Sector: A Case Study of Dapoli City, Ratanagiri. Journal of Research Proceedings, 15-22.

Dl, D. S., & Ramesh D. (2013). Performances of Indian Postal Services, Innovare Journal of Business management, 1 (2), 5-10.

Ghosh, D. (2007). Financial Inclusion through micro finance in India and emerging role of POSB: An analysis, All India Commerce Conference, Osmania University, Hyderabad, August 9, 2007.

Jothilakshmi, E., & Santhi, P. (2019). A Study on Postal Savings- An Investment Alternative to The Rural Areas, International Journal of Management and Social Sciences (IJMSS), 8 (2.1), 19-22.

Kanda, R. & Bhalla, G.S. (2020). Financial Performance and Administrative Efficiency of Indian Post Offices: A Case Study of North-Western India. Dogo Rangsang Research Journal. 10(7), 5-15.

Karthikeyan. B. (2016). Investors Attitude towards Post Office Deposit Schemes. Indian Journal of Applied Research, 6 (9), 303-305.

Manimekalai, R. & Ragunathan, T. (2021). A Study On The Postal Saving Scheme In Sub Post Office Special Reference To Uthangarai Taluk, International Journal of Aquatic Science, 12(2), 219-227.

Mathew, S. (2020). SWOT Analysis on Indian Postal Schemes-Study on the Post Office Savings Bank of Kerala Circle. International Journal of Scientific Development and Research, 5(10), 213- 223.

Mathew, S. (2015). Strategic Role of Post Office Savings Bank towards Prosperity of India, Journal of Exclusive Management Science, 4 (1), 1-6.

Muthusamy (2012). Investor’s Attitude towards Post Office Saving Schemes. International Journal of Physical and Social Sciences, 2(10), 225-240.

Potadar, M., Mehta, M. B., & Potdar, S. (2015). Challenges Ahead of India Post–A Review. International Journal of Research in Management, 5(1), 129-136.

Prakash, N. & Gurusamy, S. (2018). India Postal Banking Services - A Study on Its Growth, SUMEDHA Journal of Management, 7 (3), 109-120.

Priyadarshee, A., Hossain, F., & Arun, T. (2010). Financial inclusion and social protection: A case for India post. Competition & Change, 14(3-4), 324-342.

Ravindran & Venkatachalam (2016). Investment Opportunities of Postal Services in India. International Conference on "Research avenues in Social Science” Organize by SNGC, Coimbatore, 1 (3), 226- 229.

Rajeswari, M. (2017). A Study of Customer Preferences of Recurring Deposits in Post Offices over Banks. Asian Social Science, 13(7). 103-106.

Rakshit. B. and Singh. U.S. (2021). A Study on Investors Awareness of Post Office Saving Schemes with Special Reference to Hazaribag District. Jamshedpur Research Review-Govt Registered, Refereed, Peer Reviewed, Multi-Disciplinary Research Journal, 5 (48), 52-56.

Rameshkumar. N. (2018). Investor Attitude and Saving Pattern towards Post Office Saving Schemes – A Study with Special Reference to Rural Working Women of Pollachi Taluk in Coimbatore District. International Journal of Management, IT & Engineering, 8 (10), 89-100.

Sankaran. (2017). Customer Loyalty on Financial Services of India Post- A Study with reference to Kerela, PhD Thesis submitted in School of Management studies in Cochin University Of Science and Technology.

Saranya, K. & Hamsalakshmi, R. (2018). Performance of Indian Post Office Saving Schemes in Recent Trends. International Journal of Advanced Research, 6 (3), 998-1004.

Singh, M. (2020). Investor’s Perception towards Post Office Small Saving Schemes: A Case Study of Himachal Pradesh.Indian Institute of Finance, 32 (2), 585-606.

Srujana, R. & Swathi, S. (2019). A Study on Trends and Role of Small Savings in Indian Economy, Anveshana’sInternational Journal of Research in Regional Studies, Law, Social Sciences, Journalism and Management Practices, 4(12), 31-43.

Sumithra, C. G. (2016). India post: unleashing new avatar. International Journal of Research in Social Sciences, 6(7), 37-50.

Sunder, G., & Jacob, P. (2009). Post Office Savings and its Relevance in Rural Areas- A Study on the Impetus for Rural Investment with Reference to Kumbalangi in Cochin. The Indian Journal of Management, 2(1), 26-34.

Usha, M., & Miranda, M. M. (2020). Customer Perception Towards Investment in Post Office Schemes. Editorial Board, 9(10).

VA, N. A., Aithal, P. S., & Pankaje, N. (2023). A Comparison of the Mahila Samman Savings Certificate with Other Small Savings Schemes for the Empowerment of Women in India. International Journal of Case Studies in Business, IT and Education (IJCSBE), 7(2), 348-359.

WEBSITE VISITED-

www.indiapost.gov.in

WWW.rbi.org.in

scholar.google.com

www.niss.org